If you are searching to acquire a family trips domestic, you might need to get a mortgage for the property. A home loan for the the second residence is distinct from a mortgage into a primary home.

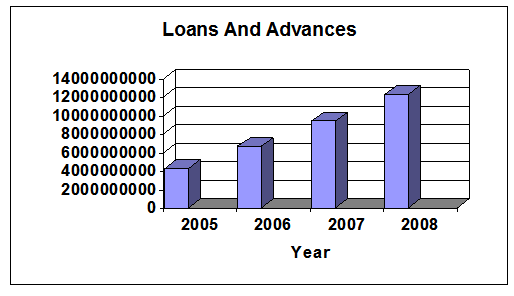

While some some one have enough money for purchase an extra household playing with dollars, really need to use away a mortgage. According to a survey from the National Organization from Realtors Lookup Agency, nearly 1 / 2 of all of the trips home buyers and you will dealers financing upwards so you can 70% of their purchase.

Here is an outline from things you need to know about capital one minute domestic. This can include whether you really can afford another home, options for and make a down payment and more.

Must i manage an additional house?

Very first, add up all the will set you back. Besides the costs which go to the pick, although will cost you that may never be instantly apparent. They have been your own deposit and you may month-to-month mortgage repayments, and closing costs, utilities, assets taxes, insurance rates, landscaping, travelling will cost you or other maintenance.

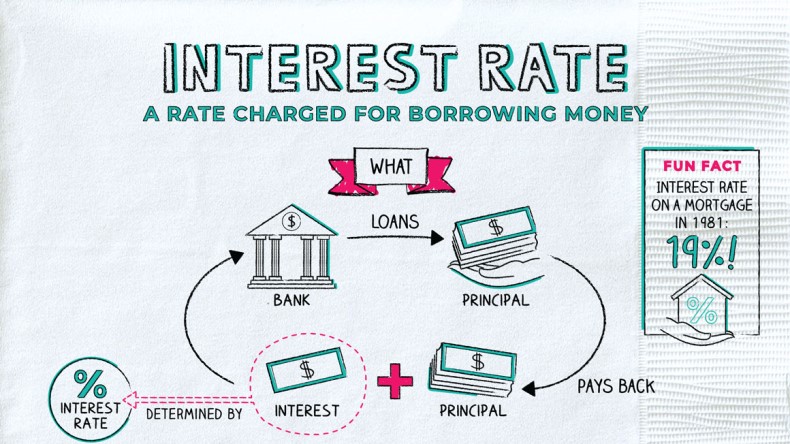

The differences between mortgage loans toward first homes and you will 2nd belongings

On the no. 1 home loan, you happen to be in a position to place as low as 5% off, dependent on your credit rating or other factors. Toward an extra household, although not, you’ll likely need certainly to lay out at least ten%. Because the the next financial basically adds more economic tension to have an effective homebuyer, loan providers generally come across a somewhat higher credit score towards a 2nd financial. Your rate of interest into the another financial can be high than simply on your own first financial.

If not, the process of making an application for the next mortgage loan is comparable to that particular from an initial residence mortgage. As with any financing, you have to do your research, talk with numerous loan providers and select the borrowed funds that actually works most readily useful to you.

Qualifying getting an additional mortgage

Before applying getting another mortgage loan, opinion your credit rating, assets and money, just like a loan provider often.

To purchase a second family, you will likely you need more money during the put aside that’ll safety your mortgage payments degrees of training a temporary loss of earnings. Well-certified some body almost certainly you prefer at the very least a couple months from reserves, when you’re reduced-qualified individuals need at the least half a year out of supplies. 30 days of put aside finance is adequate to security the fresh new month-to-month mortgage repayment into both residential property.

Debt-to-income (DTI) standards getting a moment home loan may depend on your credit get in addition to measurements of their down payment. Normally, the greater amount of you devote down and also the highest your credit score, the more likely the lender allows a high DTI.

Certain people might want to counterbalance their expenses from the renting away the travel property if they are staying away from him or her. This you will break the mortgage terms and conditions because you are having fun with the house or property since the an investment unlike a genuine 2nd household, leading to higher risk towards lender.

- Getting stayed in by the holder for many the main 12 months

- Become a-one-unit family that can be used seasons-round

- Belong only to the consumer

- Never be rented, or work at from the a control business

You may have a few options to adopt when designing an all the way down commission on the next home. You could use an earnings-aside re-finance or unlock a house Equity Line of credit (HELOC) on the current house, you can also use your coupons to make the down-payment.

1. Cash-away refinance

For those who have accumulated enough security on the number one household, a cash-aside re-finance allows you to utilize one equity, particularly when your property has grown when you look at the well worth since you bought it. Individuals with good credit can be normally borrow as much as 80% of their residence’s latest worthy of. Prior to going that it guidelines Oakwood finance loans personal, make sure you are able to afford the greater payment you can now owe on your own first household.

2. HELOC

A beneficial HELOC, or household guarantee credit line, in your first house is another common choice. For those who have enough security on the no. 1 home, you might pull out a personal line of credit and use people finance and also make a down payment on your second possessions. This means you don’t have to refinance your financial.

To acquire the next domestic may sound tough, but if you know very well what you may anticipate and feedback your money, it can be fairly easy. Continue such points in your mind as you think of if you are able another family, and how to rating home financing for it.