You should use borrowing-credit and you will settling currency using playing cards or other finance-so you’re able to make your credit score. Taking on excessive the fresh new personal debt at the same time was risky for your requirements and for lenders. Capture things one step simultaneously. Once you make an application for an alternative loan or charge card, demonstrated about six months out-of on the-big date repayments regarding account before you apply for another membership. Never ever get a whole lot more account than simply you can relatively create-it’s more significant to deal with the credit you already have responsibly than it is to apply for the new borrowing from the bank. Should you be inclined to overspend, or if perhaps it could be too difficult to keep in mind and that repayments was owed when, cannot make an application for the brand new borrowing from the bank.

You want far more assist? Meet with a therapist

A low-earnings borrowing from the bank specialist otherwise a HUD-approved housing counselor makes it possible to make a plan to alter the borrowing from the bank. Borrowing counselors can help you that have improving your borrowing from the bank, currency and personal debt administration, budgeting, and other general currency points. Counselors discuss all of your current financial situation with you, which help your create a personalized plan to solve your bank account dilemmas. Find out about how and you will how to locate an informed credit therapist for you.

Houses counselors features knowledge certain to purchasing a property and obtaining a home loan. A casing therapist discusses the borrowing from the bank, earnings, and other financial suggestions in order to understand how a home loan bank will legal the application. A housing therapist helps you decide whether now could be this new right time to pursue to get a house, otherwise whether you’re best off waiting if you don’t features enhanced your own borrowing from the bank.

Financial choices

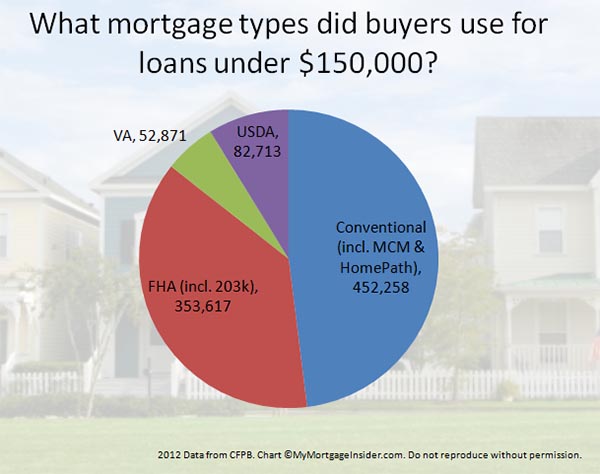

If you have decided that you want to follow to invest in an effective household today, it seems sensible to know about your own financial choice and look around to find the best rate. Whether your credit score isnt good, you to definitely option it is possible to imagine was a national Casing Administration (FHA) home loan.

FHA financing do have more versatile conditions than just antique fund. Extremely loan providers bring FHA loans to borrowers that have down fico scores than are needed to have old-fashioned funds. Additionally, it may end up being better to get an FHA mortgage after a poor events. Such as, FHA system recommendations create loan providers to look at borrowers 2 years shortly after a part eight case of bankruptcy and three-years just after a foreclosures. In the event the there were extenuating points beyond your manage (elizabeth.grams., brand new serious infection otherwise loss of a wage earner ), you could demand unique thought even ultimately. You usually need waiting seven many years to obtain a conventional financial just after going through a foreclosure.

FHA fund are produced because of the private lenders however, insured by FHA. FHA insurance policy is a form of home loan insurance policies, and therefore covers the financial institution unless you pay-off the loan. FHA insurance rates cannot protect your-if you don’t help make your costs on time, their borrowing from the bank are affected and you will face foreclosures. You only pay to own FHA insurance coverage for your bank in 2 bits-an initial fee from the closure, and you will a month-to-month advanced which is put in the homeloan payment.

A caution on the subprime mortgages

Particular loan providers can offer subprime mortgages so you can possible borrowers with all the way down fico scores. A subprime mortgage just means the latest terms of the borrowed funds aren’t as good as the newest conditions open to prime (highest credit rating) individuals. Subprime mortgage loans has rather higher interest rates than just perfect mortgages. Thus the fresh Lisman bad credit payday loans no credit check open 24/7 costs is somewhat greater than for finest mortgage loans. Have a tendency to, subprime mortgage loans is variable speed mortgage loans (ARMs). The speed towards the an arm is also increase significantly throughout the years. Subprime finance ortization. When you look at the foreclosures drama, of numerous consumers having subprime mortgages experienced dramatically improved mortgage payments and were unable and come up with men and women money.